Maximum Social Security Wage Base 2025 Calendar - Maximum Social Security Wage Base 2025 Calendar. This amount is also commonly referred to as the taxable maximum. In 2025, the wage base limit is. Maximum Social Security Benefit 2025 Calculation, In 2025, the wage base limit is. After an employee earns above the annual wage base, do not withhold money for social security taxes.

Maximum Social Security Wage Base 2025 Calendar. This amount is also commonly referred to as the taxable maximum. In 2025, the wage base limit is.

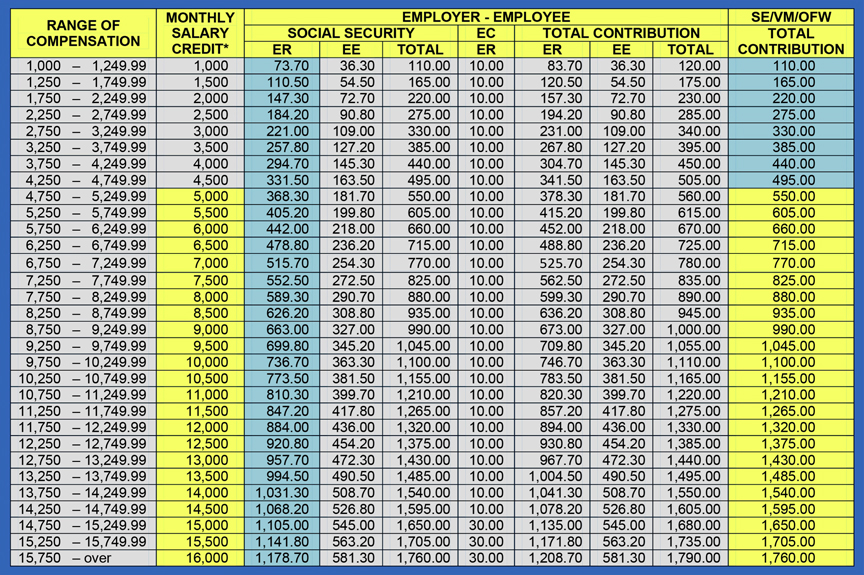

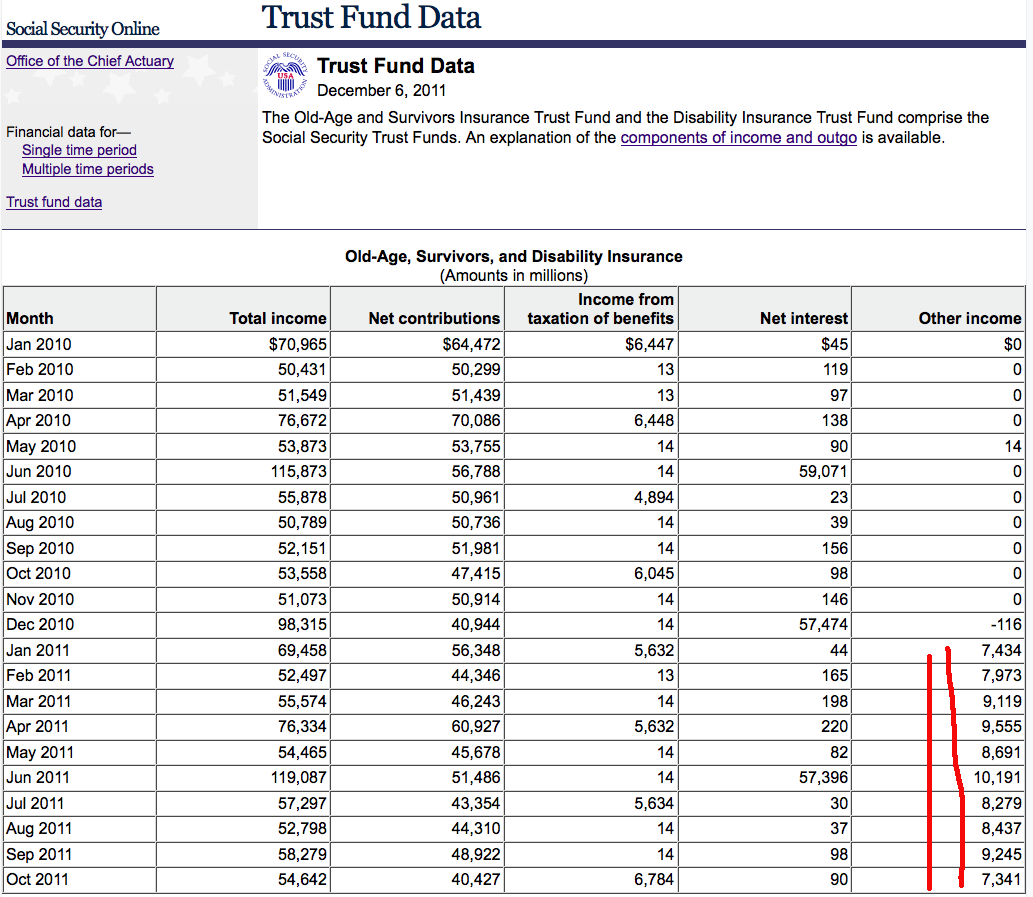

2025 Pay Tables Sari Winnah, The united states and hungary signed a social security totalization agreement that eliminates double social security taxation and fills gaps in benefits for workers who have divided their. The social security administration recently announced that the wage base for computing social security tax will increase to $168,600 for 2025 (up from $160,200 for 2025).

Social Security Maximum Contribution 2025 Kally Marinna, The social security administration (ssa) recently announced that the wage base for computing social security tax will increase for 2025 to $168,600. This means the maximum social security could possibly pay out is determined based on how much the wage base limit was during the relevant years.

Maximum Social Security Tax Withholding 2025 Calendar Lynde Kelsey, For earnings in 2025, this base is $168,600. The 2025 social security wage base is $168,600, up from the 2025 limit of $160,200.

In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. 23 jul 2025, 03:23:31 pm ist income tax budget 2025 live updates:

Social Security Tax Wage Limit 2025 Schedule Leone, We raise this amount yearly to keep pace with increases in average wages. The social security administration (ssa) recently announced that the wage base for computing social security tax will increase for 2025 to $168,600.

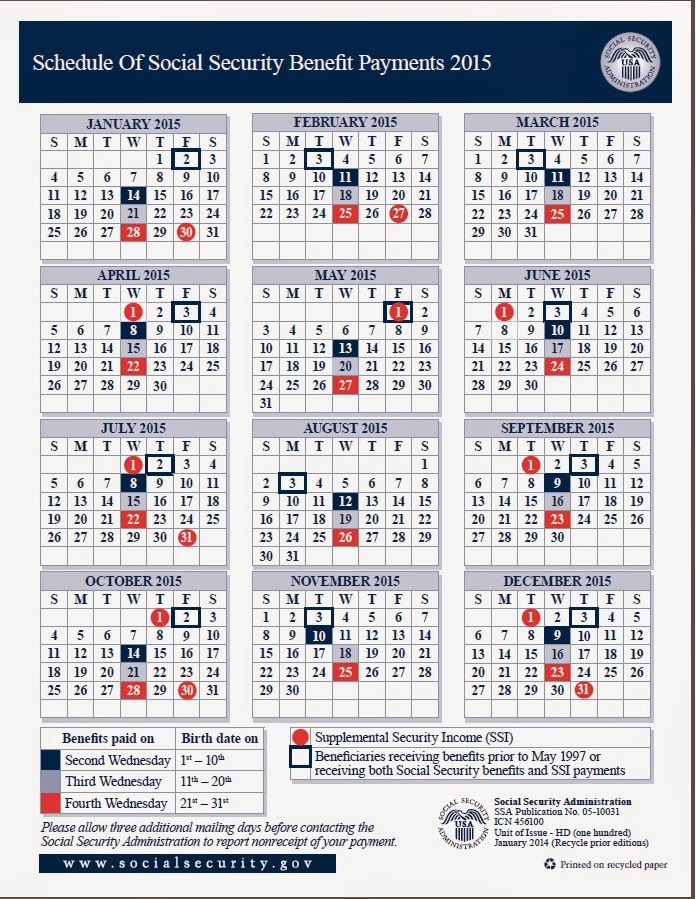

Social Security Benefits Schedule 2025 Ali Melisse, The united states and hungary signed a social security totalization agreement that eliminates double social security taxation and fills gaps in benefits for workers who have divided their. This 5.2% increase means that more of your income could be taxed.

The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2025 for leave taken after march 31, 2021, and.

Maximum Social Security Benefit 2025 Increase Van Lilian, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. Starting in 2025, the maximum amount of earnings subject to social security tax will rise from $160,200 to $168,600.

Social Security Max Allowed 2025 Calendar Dredi Lynnell, The social security administration today issued a news release announcing that the social. The social security administration (ssa) recently announced that the wage base for computing social security tax will increase for 2025 to $168,600.

Social Security Wage Base Limit 2025 Calendar Cyndie Thomasin, This amount is also commonly referred to as the taxable maximum. This limit changes each year with changes in the national average wage index.

What’s the maximum you’ll pay per employee in social security tax next year?

Social Security 2025 Calendar 2025 Calendar Printable, This amount is also commonly referred to as the taxable maximum. The 2025 limit is $168,600, up from $160,200 in 2025.

For 2025, the fica tax rate for employers will be 7.65% — 6.2% for social security and 1.45% for medicare (the same as in 2025).